Original Research

Predicting an Impact of Solvency on the SDGS Disclosure in LQ-45 Firm Indonesia Stock Exchange Period of 2021-2023

- Abstract

- Full text

- Metrics

This study focuses on predicting the impact of solvency on the disclosure of SDGs by Indonesian firms listed on the Indonesia Stock Exchange (IDX) at the LQ-45 Index from 2021 to 2023. This study takes a positivist method, with a quantitative approach. Subsequently, study documentation and content analysis tools were employed to gather the research findings, specifically examining the link between the determination of SDGs disclosure. Collecting data for this study utilizing the content analysis method by scoring computed from every firm’s sustainability reporting (SR) disclosures in annual reports (audited). SDGs can be used as a standard for measuring sustainability reporting. Measuring the level of sustainability reporting using 17 SDGs components using the score method. The content analysis used a Ratio scale. Data processing was done using the Microsoft Excel application to create a template for content analysis. The summary in this study inferred that: (1) There is no impact of solvency with Debt-to-Asset Ratio (DAR) on the SDGs disclosure positively. (2) There is no impact of solvency with Debt-to-Equity Ratio (DER) on the SDGs disclosure negatively. (3) Firm size is examined as a control variable for solvency about the DAR and DER on SDGs disclosure. (4) Only 6.9 percent contribution of Solvency to predict the SDGs disclosure.

Predicting an Impact of Solvency on the SDGS Disclosure in LQ-45 Firm Indonesia Stock Exchange Period of 2021-2023

Siti Wardah Pratidina Nasution

Management, Universitas AlWashliyah, Medan- Indonesia

ABSTRACT:

This study focuses on predicting the impact of solvency on the disclosure of SDGs by Indonesian firms listed on the Indonesia Stock Exchange (IDX) at the LQ-45 Index from 2021 to 2023. This study takes a positivist method, with a quantitative approach. Subsequently, study documentation and content analysis tools were employed to gather the research findings, specifically examining the link between the determination of SDGs disclosure. Collecting data for this study utilizing the content analysis method by scoring computed from every firm’s sustainability reporting (SR) disclosures in annual reports (audited). SDGs can be used as a standard for measuring sustainability reporting. Measuring the level of sustainability reporting using 17 SDGs components using the score method. The content analysis used a Ratio scale. Data processing was done using the Microsoft Excel application to create a template for content analysis. The summary in this study inferred that: (1) There is no impact of solvency with Debt-to-Asset Ratio (DAR) on the SDGs disclosure positively. (2) There is no impact of solvency with Debt-to-Equity Ratio (DER) on the SDGs disclosure negatively. (3) Firm size is examined as a control variable for solvency about the DAR and DER on SDGs disclosure. (4) Only 6.9 percent contribution of Solvency to predict the SDGs disclosure.

KEYWORDS: Solvency, DAR, DER, SDGs Disclosure

The phenomenon of Sustainable Development Goals (SDGs) disclosure following the Covid-19 pandemic in Southeast Asia has shown a significant increase in sustainability attention and reporting by enterprises in the region. The Covid-19 pandemic has reinforced the urgency for companies to adopt more sustainable and responsible practices, in consort with the SDGs agenda initiated by the United Nations (UN). Some of the major trends emerging in SDGs disclosure in Southeast Asia post-pandemic include: (1) Increased Focused on Health and Well-Being, (2) Acceleration of Digitalization and Quality Education, (3) Increased Focus on Innovation and Infrastructure, (4) Awareness of Economic Resilience and Reducing Inequality, (5) Focus on Climate Action and Natural Resource Management, (6) Global Collaboration and Partnership (UNDP, 2023).

According to a survey report released by Price Waterhouse Coopers on 470 companies in 17 countries, among others, it explains that 62 percent of world firms have included sustainable development goals in their reports, but only 37 percent of enterprises are unclear about the circumstances; the majority target the SDGs that are the targets of their companies. Furthermore, there are still many enterprises that do not align their business targets with the SDGs (PwC, 2017, p. 4). In the 2023 Global Sustainable Development Report released by the United Nations, Indonesia has risen from the 102th position in 2019 to the 75th position globally. Indonesia's SDGs index increased from 64.2 in 2019 to 70.2 in 2023. The report also indicates that 63 percent of indicators have reached their targets, while 16 percent of other indicators have shown significant improvement. Indonesia is noted as one of the countries with the most progressive achievements in the SDGs among upper-middle-income countries. The achievement of the SDGs is highly dependent on the participation of the business sector in Indonesia (Indonesian Consulate General in Osaka, 2024).

Financial information can be interpreted as a measure of managerial performance achievement in enterprises, based on the components of a firm's performance as reflected in the financial ratios (Yulianto et al., 2024). One aspect of the financial ratio used to ensure or provide assurance of a company's ability can be measured by the firm's solvency. This factor is crucial in evaluating the settlement of obligations/debts for firms, both in the short and long term. Furthermore, good measurement of company solvency can certainly be used to see its relationship with the CSR disclosure, sustainability reporting (environment, economics, and social issues), and Sustainable Development Goals (SDGs), such as those of Li et al. (2020); Haladu and Bin-Nashwan (2022); and Girón et al. (2021); who investigated the one implication of corporate leverage on the CER and sustainability practices using one of the control and exploratory variables, viz, the firm's leverage ratio with a comparison of total assets/equity (DR/DER) in Chinese, Nigerian, and African-Asian context. Those findings confirm that the third testing of financial leverage significantly impacts CER and SDGs negatively. Research conducted by Okoba and Chukwu (2023) using debt-to-equity has confirmed a positive relationship with social sustainability performance disclosure in the Nigerian context.

Research indicates that the average SDGs disclosure in Indonesia is alarmingly low, with only about 8 percent according to the business actions and 20 percent on SDG targets (Wicaksono, 2023). This lack of transparency hinders the industry's ability to align with global sustainability standards. Financial leverage positively influences the quality of sustainability disclosures, yet many companies still struggle to adequately report their SDG commitments (Windari & Dewi, 2024). The quality and extent of SDGs disclosure are heavily influenced by firm financial assessment, including solvency. This study focuses on verifying the impact of solvency on SDGs disclosure of Indonesian firms in the Indonesia Stock Exchange (IDX) at LQ-45 Index 2021-2023.

Literature Review

Agency Theory

Agency theory, introduced by Jensen and Meckling (1976) as a basic reference for accounting and management science, reveals the linkage between the principal (shareholders) and the management (agent). According to Scott (2015, p. 340), who defines agency theory, it is concluded that there are differences in interests that have the potential to cause agency conflicts, due to the asymmetric information, where the agent does not work in the best interest of the principal. Information asymmetry is the main factor that causes the capacity of information obtained by each party, namely the agent and the principal, to be unbalanced. This condition certainly opens up management opportunities (agent) to act opportunistically, so that it can cause agency costs. By emphasizing the importance of sustainability goals, principals can pressure agents to integrate SDGs into business strategies. This helps prevent agents from taking opportunistic actions that prioritize short-term profits, while principals aim to ensure the company achieves sustainable growth that encompasses social, economic, and environmental aspects (Ponce & Wibowo, 2023). Overall, the SDGs can help align the long-term interests of companies with the expectations of stakeholders, as well as create synergy between agents and principals through increased transparency, accountability, and sustainability reporting.

Voluntary Disclosure Theory

Mainly, disclosure is an integral part of financial reporting. Particularly, disclosure is the last phase in the accounting cycle, which is the business information outlook in the form of a set of financial statements. Disclosure, based on the Australian Accounting Standards Board – AASB 18 (2024, p. B138, 50), defines an adjustment as a means of providing useful information to performance quantification, highlighting which items are essential to business operations. It does not encompass general or private statements made by enterprises or information supplied, excluding the financial statement. Further, disclosure is construed as serving more information than what can be presented in the formal financial statements.

In the context of cost of capital disclosure, as in Brazil, Zaro's (2019) study found that the effects of voluntary disclosures do not necessarily mimic those of mandatory disclosures because firms may act strategically. Furthermore, voluntary disclosure of the cost of capital in countries with low legal enforcement may rely on characteristics that encourage companies in those countries to voluntarily disclose integrated reports (Vale Castelo et al., 2021).

Disclosure of sustainability reports carried out by a company is disclosed or communicated to all stakeholders regarding economic, environmental, and social performance in realizing the SDGs. Corporate social responsibility encompasses aspects of the environment, employment, social and community development, and product responsibility. The company must disclose this information in its sustainability report. In contrast, disclosure outside of these aspects in the sustainability report is voluntary.

Solvency

Solvency is one of the components of the financial ratio in seeing the ability to settle the entreprise obligations. Leverage is one of the proxies included in the firm's solvency, namely the debt ratio. This ratio aims to determine the availability of funds from creditors for the owner's equity, which functions to ensure the availability of every rupiah of the equity used as collateral for debt (Kasmir, 2021, p. 158). According to Keown et al. (2017) and Kasmir (2021, p. 153) firm solvency can be measured using several approaches:

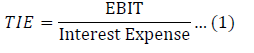

a) Time Interest Earned (TIE); or foremost, as the interest coverage ratio used by companies is also one of the ways to assess the firm's solvency. This measurement is used to assess the corporation’s ability to meet its interest obligations (Ross et al., 2022, p. 59). Time Interest Earned can be calculated using the formula:

b) Debt-to-Assets Ratio (DAR); the DAR measurement is used to assess a corporate’s ability to finance the amount of company assets financed by debt. This DAR proxy can be calculated using the formula:

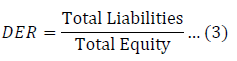

C) Debt-to-Equity Ratio (DER); the DER measurement is used to assess the corporate’s funding ability which comes from the business capital structure. The DER can be calculated using the formula:

Sustainable Development Goals (SDGs)

Before the SDGs, the world used the Millennium Development Goals (MDGs), which consisted of 8 global goals set in 2000 to be achieved by 2015. The SDGs revolved around minimizing destitution and restoring health and education, and raising incomes in developing countries (WHO, 2018). In Rio de Janeiro 2012 (Rio+20), the SDGs began to be adopted at the United Nations (UN) Conference on Sustainable Development.

According to the Global Reporting Initiative (GRI, 2018) and KPMG, it is necessary to achieve consensus on the SDGs. Consequently, some large firms have begun to create SDG reconciliations in their public releases to demonstrate their commitment to sustainable development. This implementation was also encouraged by the United Nations Global Compact (UNGC), which arranged a common approach with the GRI to aid enterprises in incorporating the SDGs into their purpose and reporting phases (Arena et al., 2023).

Based on the 2023 G20/OECD Principles of Corporate Governance on Sustainability and Resilience, enterprises play an essential role in the economy by creating jobs, driving innovation, generating prosperity, and providing the goods and services that society needs. States around the world have committed to transitioning to a sustainable, low-carbon economy under the Sustainable Development Goals (SDGs) (See Figure 1) and the Paris Agreement. This requires corporations to be able to adapt quickly to resolve regulations and business viability, taking into account various policies and transition works in each jurisdiction (OECD, 2023, p. 44).

Sustainable Development Goals – SDGs Knowledge Platform (United Nations, 2024)

Empirical Review

Aboody et al. (2004) argued that the main reason companies may be constrained to disclose more sustainability reporting information, given financial leverage, is to appeal to other investors, create a good business reputation, and meet long-term creditors (Haladu & Bin-Nashwan, 2022). Similarly to Li et al.’s (2020) research, the leverage ratio is the primary component for utilizing the aptitude of the business entity to refund debts, and it likewise reflects the debt risk level. A high leverage ratio indicates a higher risk level for the business. Several other studies, such as Girón et al. (2021) involve 366 African and large Asian enterprises use the debt proxy to provide empirical evidence that leverage shows a significant impact on the sustainability reporting and business economic performance. Furthermore, the financial leverage, as indicated by the long-term debt proxy and debt-equity ratio, confirms that it negatively influences the sustainability reporting in Nigeria's context (Haladu & Bin-Nashwan, 2022; Okoba & Chukwu, 2023). And finally, the leverage level age has strengthened the relationship to determine its implications for SDGs in the context of Oman, Saudi Arabia, United Arab Emirates, Kuwait, and Bahrain (Al-Qudah & Houcine, 2024).

Several previous research results above conclude that the company's leverage variable, including debt, debt-equity, and long-term measurements, confirms the linkage between firm sustainability disclosure and its financial health. In the situational context of several cases found, low solvency can encourage companies to be more proactive in disclosing SDGs as a reputation strategy, especially if there is pressure from stakeholders. A healthy solvency level sends a positive signal to stakeholders, so companies may be more motivated to report SDGs disclosures as an effort to strengthen their legitimacy. Thus, the formulation of the research hypothesis is stated below:

H1: There is an impact of solvency with Debt-to-Asset Ratio (DAR) on the SDGs disclosure.

H2: There is an impact of solvency with Debt-to-Equity Ratio (DER) on the SDGs disclosure.

Method

This study takes a positivist method, with a quantitative approach. The quantitative design can be chosen for gathering information about annual surveys from annual and sustainability reports from the LQ-45 Index on the Indonesian Stock Exchange (IDX) from 2021 to 2023. Then, study documentation and content analysis tools were used to analyze the research questions, focusing on the linkage between the determination of SDGs disclosure. The cornerstone of quantitative analysis is the quantified and centralized data linkage to the item SDGs, encompassing the actions counted and the sum of indicators monitored by firms, based on the information recognized through content analysis of the reports (Nechita et al., 2020).

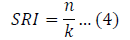

Hereinafter, several studies are time-series or cross-sectional. Collecting data for this study utilizing the content analysis by scoring computed from a method in firms’ Sustainability Reporting (SR) disclosures in annual reports (audited). SDGs can be used as a standard for measuring sustainability reporting. Measuring the level of sustainability reporting using 17 SDGs components using the score method. All values will be added up and divided by 17 according to the number of SDGs components so that the final sustnainability reporting value ranges from zero to one (Gunawan & Tin, 2018). The SDGs Disclosure can be calculated using the formula:

SRI = Sustainability Reporting Index

n = Total items disclosed

k = Total SDGs items expected

Table 1 presents the SDGs Disclosure based on the 17 pillars of sustainability reporting.

Structure of SDGs Components

|

Sustainable Development Goals (SDGs) |

Target | Sub |

Objective |

|

SDGs 1 (No Poverty) |

5 | 2 |

Eradicating poverty in any form. This SDGs is focused because there is still a lot of poverty that occurs in human life to this day |

|

SDGs 2 (Zero Hunger) |

5 | 3 |

Reducing the number of people suffering from malnutrition |

|

SDGs 3 (Good Health and Well-Being) |

9 | 4 |

Focusing on human health and well-being as it is essential for sustainable development |

|

SDGs 4 (Quality Education) |

7 | 3 |

Providing quality education for all people because education is essential for sustainable development |

|

SDGs 5 (Gender Equality) |

6 | 3 |

Ending discrimination against women because basically all humans have their own abilities |

|

SDGs 6 (Clean Water and Sanitation) |

6 | 2 |

Ensuring that all humans have access to clean water that is safe for consumption and use for other life needs |

|

SDGs 7 (Affordable and Clean Energy) |

3 | 2 |

Ensure that all people have access to clean energy to meet their life needs |

|

SDGs 8 (Decent Work and Economic Growth) |

10 | 2 |

Promoting higher productivity growth, sustainable economy and technological innovation |

|

SDGs 9 (Industry, Innovation and Infrastructure) |

5 | 3 |

Building resilient infrastructure, promoting sustainable industry and enhancing innovation |

|

SDGs 10 (Reduced Inequalities) |

7 | 3 |

Eliminating disparities for low-income communities and boosting the community economy regardless of race, gender, and ethnicity |

|

SDGs 11 (Sustainable Cities and Communities) |

7 | 3 |

Make cities and human settlements inclusive, safe, resilient, and sustainable |

|

SDGs 12 (Responsible Consumption and Production) |

8 | 3 |

Encourage efficient use of resources and energy and environmentally friendly production activities |

|

SDGs 13 (Climate Action) |

3 | 2 |

Reducing extreme climate change caused by emissions resulting from factory production processes |

|

SDGs 14 (Life below Water) |

9 | 1 |

Protecting marine ecosystems sustainably from pollution |

|

SDGs 15 (Life on Land) |

9 | 3 |

Managing forests, combating desertification, and preventing biodiversity loss |

|

SDGs 16 (Peace, Justice and Strong Institutions) |

9 | 3 |

Reducing all forms of violence and working together with various parties to end the conflict |

|

SDGs 17 (Partnerships for the Goals) |

19 |

Introducing international trade and helping developing countries |

Source: Developed in this research (2025) from: (UNDP, 2023; United Nations, 2024)

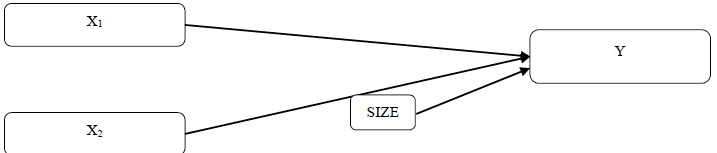

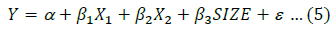

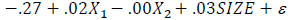

The Solvency measure with the Debt-to-Asset Ratio (DAR) (X1 variable) and the Debt-to-Equity Ratio (DER) (X2 variable) proxy in this study. The content analysis used a Ratio scale. Data processing was conducted using the Microsoft Excel application to create a template for content analysis. After inputting the overall data, the percentage of SDGs Disclosure (Y) was calculated. Firm Size as a control variable (SIZE). Figure 2 presents the proposed model for this research formulated as follows:

The Proposed Model Research (2025)

Then, the formulation for the regression equation on X1, X2, and Y was carried out with the multiple equation analysis below:

Results

Table 2 presents descriptive statistics for four variables: Sustainable Development Goals (SDGs) Disclosure, Solvency (DAR, as X1 and DER, as X2), and Firm Size (FS, as a control variable), generating results from 126 data observations. On average, SDGs disclosure LQ-45 firms listed on IDX period 2021-2023 average to 20.79 of SDGs disclosure, which demonstrates differences in average between the lowest and highest firm percentage, ranging from .04 to .53. The analysis reveals diverse Debt-to-Assets Ratios (DAR) across firms, given an average score of .49 and a .27 standard deviation, while the range is between .03 and 1.72. Firms possess a moderate Debt-to-Equity Ratio (DER) as exhibited through the average score of 1.72, yet demonstrate significant variability (SD = 2.56), while the lowest observed DER was negative (-.40) and the highest DER measurement was 15.30. Findings show an average firm size of 13.85, indicating a widespread presence of large-sized firms, while a standard deviation of .61 demonstrates differences in firm scale between the smallest firm at 12.59 and the largest firm at 15.33, established through firm size that reached a maximum of 15.33.

Descriptive Statistics among Sustainable Development Goals (SDGs) Disclosure, Solvency, and Firm Size

|

|

|

Descriptive Statistics |

|

|

|

|

SDGs (Y) |

DAR (X1) |

DER (X2) |

SIZE |

|

Min Score |

0.04 |

0.03 |

-0.40 |

12.59 |

|

Max Score |

0.53 |

1.72 |

15.30 |

15.33 |

|

M |

0.20 |

0.49 |

1.72 |

13.85 |

|

SD |

0.09 |

0.27 |

2.56 |

0.61 |

Yields of Classical Assumption

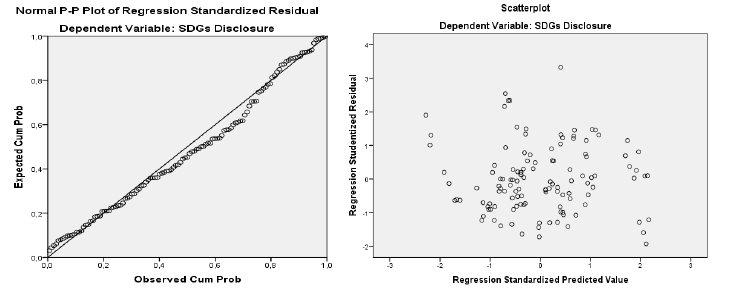

Figure 3 demonstrates data normality assumptions. The chart was generated on the assumption of normality by examining the graph, which indicates that the plotting points consistently follow and approach the diagonal line of the residual score, thereby confirming compliance with the data's normality assumptions. Hereinafter, in the heteroscedasticity test, which proceeds, there is no obvious scheme, as the points are scattered above and below 0 points on the Y axis, meaning that they fulfill the heteroscedasticity assumption.

P-Plots and Scatter Diagram – Data Normality and Heteroscedasticity

Yields of Hypothesis Testing

Table 3 presents multicollinearity assumptions. The VIF score of each variable from Solvency with Ln_DAR (X1) and Ln_DER (X2) proxies is 3.08 and .32, while the Tolerance value is obtained at .32 and .28. For the control variable, namely company size, it produces a VIF score of 1.37 and a Tolerance value of .72. Based on the produces above, it has fulfilled the assumption of no symptoms of multicollinearity because it is at a VIF of less than 10 and a Tolerance greater than 0.1. Hereinafter, in the autocorrelation test, which produces an initial dW value of .77, meaning the dW value < dU (1.73), where there is positive autocorrelation. The Cochrane-Orcutt is one of the methods used to overcome the problem of autocorrelation, where research data is changed into a "lag" equation (Ghozali, 2021, p. 121). After being reprocessed into an equation in the form of "lag", the current Durbin Watson value is obtained at 2.420, which requires the dW score to be among dU and 4-dU.

Yields of Multicollinearity and Autocorrelations

|

|

|

Multicollinearity and Autocorrelations |

Cochrane Orcutt |

||

|

|

VIF Score |

Tolerance Score |

dU, dL Score |

dW Score |

|

|

Ln_X1 |

3.08 |

0.32 |

1.737 |

0.77 |

2.01 |

|

Ln_X2 |

3.48 |

0.28 |

1.73 |

||

|

SIZE |

1.37 |

0.72 |

Requisite |

dU < dW < 4-dU |

|

As shown in Table 4, the yields of the multiple regression equation produce:

Yields of Regression Test

|

|

|

Regression Analysis |

Coefficient Determinants Analysis |

|||||

|

|

Coefficients |

t-Stats. |

Sig. Prob |

Conclusions |

R-Score |

R-Square (R2) |

||

|

Constant |

-.27 |

-1.19 |

.23 |

- |

.26 |

.06 |

||

|

Ln_X1 |

.02 |

0.88 |

.37 |

H1 Reject |

||||

|

Ln_X2 |

-.00 |

-0.44 |

.56 |

H2 Reject |

||||

|

SIZE |

.03 |

2.18 |

.03 |

- |

It means “Low Correlations”, and “Low Contributions” |

|||

|

F-Testing |

2.89 |

.03 |

Ha Accept |

|||||

Discussion

The solvency with Debt-to-Assets Ratio (DAR) of the listed LQ-45 firms shows a positive coefficient period of 2021-2023, although it is insignificant at 5% (.02; < 1.97 = prob. is .37). The yields are above what is predicted by the existing condition of DAR in LQ-45 firms, which would not impact the SDGs disclosure. Therefore, H1 is Reject. These findings are not in accordance with Girón et al. (2021) and Al-Qudah and Houcine (2024) Research, which suggests that the debt-to-asset ratio has a negative implication for the sustainability reporting in Asia and African companies and SDGs in GCC countries, implying that the size of the DAR score does not guarantee that the company will become more transparent, including SDGs disclosure.

The solvency with Debt-to-Equity Ratio (DER) of the listed LQ-45 firms shows a negative coefficient period of 2021-2023, although it is insignificant at 5% (-.006; < 1.97 = prob. is .56). The yields are above what is predicted by the existing condition of DER in LQ-45 firms would not impact the SDGs disclosure. Therefore, H2 is Reject. These findings are consistent with the findings of Li et al. (2020), Haladu and Bin-Nashwan (2022) and Okoba and Chukwu (2023) research, which suggests that the debt-to-equity ratio has a negative, but insignificant implication to the Corporate Environment Responsibility (CER) in Chinese, sustainability reporting and SSPD in the Nigerian context. It means that the size of the DER score does not guarantee that the company will become more transparent, including SDGs disclosure.

By utilizing control variables, i.e., the firm size with log-naturals of total assets (LNTA) of the listed LQ-45 firms, we find a negative coefficient for the period 2021-2023, although it is significant at 5% (.03; > 1.97 = prob. is .031). The yields suggest that the DAR and DER proxy indicate that the ineffectiveness of debt measurement in agency theory serves as a mechanism for companies to enhance transparency regarding sustainability aspects, as creditors often do not fully internalize these issues. This condition is also characterized by a low contribution of only 6.9 percent, which is influenced by Solvency as SDGs disclosure. The remaining 93.1 percent is still largely determined by other variables.

Conclusion

The summaries in this study inferred that:

- There is no impact of solvency with Debt-to-Asset Ratio (DAR) on the SDGs disclosure positively

- There is no impact of solvency with Debt-to-Equity Ratio (DER) on the SDGs disclosure negatively

- Firm size to examine Solvency with the DAR and DER on the SDGs disclosure becomes a control variable

- Only 6.9 percent contribution of Solvency to predict the SDGs disclosure

This study has several limitations, including: (1) LQ-45 indexed companies have many sectors and SDGs disclosure criteria in separate reporting versions, such as ESG and GRI, which have the potential to be very subjective and biased in disclosing SDGs. (2) The observation period is also relatively short. (3) Low contribution in predicting SDGs because it only uses one factor, i.e., Solvency. Therefore, this study should focus on specific sectors with particular sustainability measurement groupings in content analysis, and it is also important to extend the research period. Then, the low contribution generated in predicting SDGs disclosure must be complemented by incorporating many other important variables into the upcoming agenda related to sustainability, which focuses on the 17 SDGs disclosure pillars.

References

AASB. (2024). Presentation and Disclosure in Financial Statements. Victoria, Australia: Commonwealth of Australia. Retrieved from https://aasb.gov.au/admin/file/content105/c9/AASB18_06-24.pdf

Aboody, D., Barth, M., & Kasznik, R. (2004). Firms' voluntary recognition of stock‐based compensation expense. Journal of Accounting Research, 42(2), 123–150. https://doi.org/10.1111/j.1475-679X.2004.00132.x

Al-Qudah, A. A., & Houcine, A. (2024). Firms’ characteristics, corporate governance, and the adoption of sustainability reporting: Evidence from gulf cooperation council countries. Journal of Financial Reporting and Accounting, 22(2), 392–415. https://doi.org/10.1108/JFRA-02-2023-0066

Arena, M., Azzone, G., Ratti, S., Urbano, V. M., & Vecchio, G. (2023). Sustainable development goals and corporate reporting: An empirical investigation of the oil and gas industry. Sustainable Development, 31(1), 12–25. https://doi.org/10.1002/sd.2369

Brigham, E., & Houston, J. (2019). Fundamentals of finance management (15th Ed.). Cengage Learning.

Ghozali, I. (2021). Aplikasi analisis multivariate dengan program IBM Statistik SPSS 26 (10th Ed.). Badan Penerbit Universitas Dipenogoro.

Girón, A., Kazemikhasragh, A., Cicchiello, A. F., & Panetti, E. (2021). Sustainability Reporting and firms’ economic performance: Evidence from Asia and Africa. Journal of the Knowledge Economy, 12(4), 1741–1759. https://doi.org/10.1007/s13132-020-00693-7

GRI. (2018). Integrating the sustainable development goals into corporate reporting: A practical guide. Global Reporting Initiative, United Nations Global Compact. https://unglobalcompact.org/library/5628

Gunawan, J., & Tin, S. (2018). The development of corporate social responsibility in accounting research: Evidence from Indonesia. Social Responsibility Journal, 15(5), 671–684. https://doi.org/10.1108/SRJ-03-2018-0076

Haladu, A., & Bin-Nashwan, S. A. (2022). The moderating effect of environmental agencies on firms’ sustainability reporting in Nigeria. Social Responsibility Journal, 18(2), 388–402. https://doi.org/10.1108/SRJ-07-2020-0292

Indonesian Consulate General in Osaka. (2024, February 29). Indonesia Advocates for Sustainable Development at World Expo 2025 Osaka. Retrieved Agustus 2024, from Indonesian Way: https://kemlu.go.id/portal/en/read/5783/berita/indonesia-usung-pembangunan-berkelanjutan-di-world-expo-2025-osaka

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Kasmir. (2021). Analisis laporan keuangan [Financial statement analysis] (Vol. 13). Depok: Rajawali Pers.

Keown, A. J., Martin, J. D., & Petty, J. W. (2017). Foundations of finance: The logic and practice of financial management (9th Ed.). Pearson Education.

Li, Z., Wang, Y., Tan, Y., & Huang, Z. (2020). Does corporate financialization affect corporate environmental responsibility? An empirical study of China. Sustainability, 12(9), 3696. https://doi.org/10.3390/su12093696

Nechita, E., Manea, C. L., Irimescu, A. M., & Nichita, M. (2020). The content analysis of reporting on sustainable development goals. Audit Financiar, XVIII(160), 831–854. https://doi.org/10.20869/AUDITF/2020/160/030

OECD. (2023). G20/OECD Principles of Corporate Governance. Paris: Organisation for Economic Co-Operation and Development Publications. https://www.oecd.org/content/dam/oecd/en/publications/reports/2023/09/g20-oecd-principles-of-corporate-governance-2023_60836fcb/ed750b30-en.pdf

Okoba, D., & Chukwu, G. J. (2023). Firm characteristics and social sustainability performance disclosures in Nigeria. Fuoye Journal of Accounting and Management, 6(1), 111–132.

Ponce, H. G., & Wibowo, S. A. (2023). Sustainability reports and Disclosure of the Sustainable Development Goals (SDGs): Evidence from Indonesian listed companies. Sustainability, 15(24), 16919. https://doi.org/10.3390/su152416919

PwC. (2017). SDG Reporting Challenge 2017: Exploring Business Communication on the Global Goals. London: Price Water House Coopers. Retrieved from https://www.pwc.com/gx/en/sustainability/SDG/pwc-sdg-reporting-challenge-2017-final.pdf

Ross, S., Westerfield, R., & Jordan, B. (2022). Fundamentals of corporate finance (13th Ed.). McGraw Hill.

Scott, W. R. (2015). Financial accounting theory (7th Ed.). Prentice-Hall International, Inc.

Subramanyam, K. (2019). Financial statement analysis (Book 2) (11th Ed.). (T. Maulana, Trans.) Jakarta: Salemba Empat.

UNDP. (2023). SDG Digital Acceleration Agenda. New York. US: International Telecommunication Union and United Nations. Retrieved from https://www.undp.org/sites/g/files/zskgke326/files/2023-09/SDG%20Digital%20Acceleration%20Agenda_2.pdf

United Nations. (2024). Do you know all 17 SDGs? Sustainable Development, Department of Economic and Social Affairs, New York, US. https://sdgs.un.org/goals

Vale Castelo, D. d., Nossa, V., Costa, F. M., & Monte-Mor, D. (2021). Voluntary Disclosure of Integrated Reporting and Cost of Capital in Brazil: an Alternative Explanation. New Challenges in Accounting and Finance, 6(1), 1-15. https://doi.org/10.32038/NCAF.2021.06.01

WHO. (2018, February 19). Millennium Development Goals (MDGs). (World Health Organization) Retrieved September 2024, from Newsroom/Fact Sheets/Detail/: https://www.who.int/news-room/fact-sheets/detail/millennium-development-goals-(mdgs)

Wicaksono, A. N. (2023). Eksploration of Sustainable Development Goals (SDGs) Disclosure in Indonesia. Jurnal Akademi Akuntansi (JAA), 6(1), 125–156. https://doi.org/10.22219/jaa.v6i1.26448

Windari, R. A., & Dewi, Y. K. (2024). Evaluating mandatory corporate social responsibility disclosure policies and sustainability development goals achievement in Indonesia. Yustisia Jurnal Hukum, 13(1), 1–26. https://doi.org/10.20961/yustisia.v13i1.81940

Yulianto, K. I., Lumbanraja, T., Rahmadi, Z. T., Husain, T., & Hakim, L. (2024). Earnings quality factors and firm's value in Indonesian manufacturing during Covid-19. The Seybold Report, 19(10), 181–200. https://doi.org/10.5281/zenodo.13937873

Zaro, E. (2019). Cost of capital and voluntary disclosure of integrated reporting: the role of institutional factors. Faculdade de Economia, Administração e Contabilidade, Tese de doutorado. SP, Brasil: Universidade de São Paulo. Retrieved from http://www.teses.usp.br/teses/disponiveis/12/12136/tde-24052019-121105/pt-br.php

Download Count : 39

Visit Count : 96

Keywords

Solvency; DAR; DER; SDGs Disclosure

How to cite this article

Nasution, S. W. P. (2025). Predicting an impact of solvency on the SDGS disclosure in LQ-45 firm Indonesia Stock Exchange period of 2021-2023. New Challenges in Accounting and Finance, 14, 1-13. https://doi.org/10.32038/NCAF.2025.14.01

Acknowledgments

Not applicable.

Funding

Not applicable.

Conflict of Interests

No, there are no conflicting interests.

Open Access

This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. You may view a copy of Creative Commons Attribution 4.0 International License here: http://creativecommons.org/licenses/by/4.0/